Arm Lift Financing

Get pre-qualified for a personal loan in just minutes. Checking rates won’t affect your credit score

Arm Lift Loans & Financing Options

Losing weight is an incredible achievement, and many people seeking an arm lift have overcome hurdle after hurdle to lose such a significant amount of weight. After all that hard work, the only thing left to do is arm and other body lifts to remove that excess skin and give you the body you’ve worked so hard to achieve.

Of course, it’s also a surgery worth doing for many of us who are simply unhappy with the way our arms are aging. An arm lift is a costly surgery and so you may choose to use arm lift financing to fund the procedure.

Applying for arm lift financing is fast and easy:

Compare personal loan rates

Compare personal loan rates in April, 2025

What is arm lift financing?

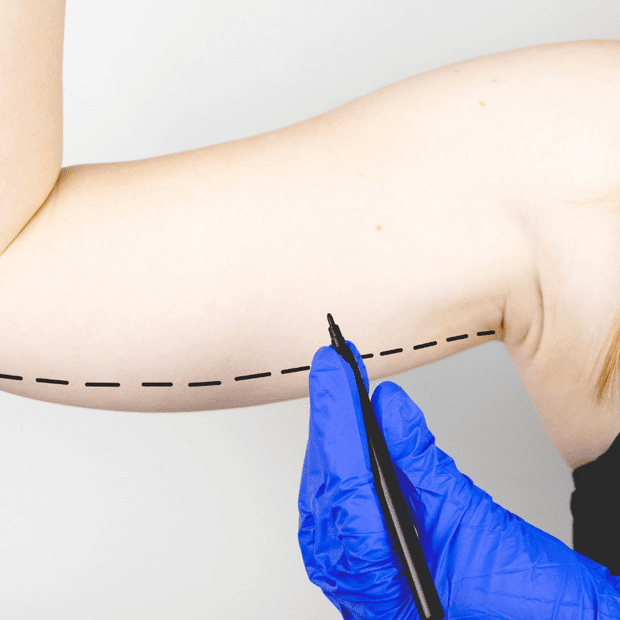

Arm lift financing refers to financial options or assistance available to individuals who are considering undergoing an arm lift procedure but may need financial support to cover the costs. An arm lift, also known as brachioplasty, is a surgical procedure aimed at improving the appearance of the upper arms by reducing excess skin and fat and tightening the underlying tissues.

Arm lift financing allows individuals to obtain the necessary funds upfront to pay for the surgery and associated expenses. It can help make the arm lift procedure more affordable by spreading out the cost over time and allowing patients to make manageable monthly payments.

How does arm lift financing work?

Most people use a personal loan to fund their arm lift surgery. With this form of financing, you borrow a lump sum amount to pay for your surgery and associated costs. This is then paid back, plus interest, weekly or monthly over a fixed term, typically between 2-5 years.

How much does an arm lift cost?

The cost of an arm lift, or brachioplasty, can vary depending on several factors, including the geographic location, the experience and expertise of the surgeon, the complexity of the procedure, the type of anesthesia used, and the specific healthcare facility where the surgery is performed. Additionally, the cost may also include pre-operative tests, post-operative care, and follow-up appointments.

On average, the cost of an arm lift in the United States can range from $4,000 to $8,000 or more. However, it's important to note that this is a rough estimate, and the actual cost can be higher or lower depending on the factors mentioned above.

Are there different types of arm lift surgery?

There are generally two kinds of arm lift surgery:

- Traditional Arm Lift: Also known as a full arm lift or standard brachioplasty, this procedure involves making an incision along the inside of the upper arm, typically from the armpit to the elbow. Excess skin and fat are removed, and the underlying tissues are tightened to improve the contour and appearance of the arm.

- Minimal Incision Arm Lift: This procedure, also called a mini arm lift or limited-incision brachioplasty, is suitable for individuals with less severe skin laxity and excess fat in the upper arm. It involves smaller incisions and focuses on targeted removal of excess tissue, usually in the upper arm area closest to the armpit. The minimal incision arm lift may result in less scarring and a faster recovery time compared to the traditional arm lift.

There are other variations on these surgeries depending on the surgeon you work with, as some use more invasive procedures for extreme sagging, often called an “extended brachioplasty.”

What qualifies as an arm lift?

Qualifying for an arm lift generally involves having the following characteristics:

- Excess skin: The presence of significant amounts of loose or sagging skin in the upper arm region that cannot be effectively improved through exercise or non-surgical treatments.

- Skin laxity: Noticeable skin laxity or loss of elasticity in the upper arm area, resulting in a "batwing" appearance or the feeling of skin hanging down when the arm is extended.

- Stable weight: It is preferable for individuals to have achieved and maintained a stable weight before considering an arm lift. Significant weight fluctuations can affect the long-term results of the procedure.

- Good overall health: Being in good general health is important for undergoing any surgical procedure, including an arm lift. This includes having no underlying medical conditions that may pose a risk during surgery and a history of proper wound healing.

- Realistic expectations: Having realistic expectations about the outcomes and limitations of the arm lift procedure is crucial. Understanding that the surgery can improve the appearance of the arms but may leave some visible scarring is important.

Will my health insurance cover an arm lift?

No, an arm lift is an elective surgery so your health insurance will not cover the expense.

Do arm lift scars fade?

Yes, arm lift scars can fade over time, but the extent of fading can vary from person to person. The appearance of scars depends on various factors, including genetics, skin type, the skill of the surgeon, and how well the patient follows post-operative care instructions.

Initially, arm lift scars may appear red, raised, or more noticeable. However, as the healing process progresses, the scars tend to become less noticeable and fade in color. It's important to note that complete scar resolution is unlikely, but most arm lift scars can become significantly less visible and blend in with the surrounding skin.

What kind of results can I expect from an arm lift?

An arm lift, or brachioplasty, can help improve the appearance of the upper arms by reducing excess skin and fat and tightening the underlying tissues. The specific results you can expect from an arm lift will depend on factors such as your individual anatomy, the extent of the procedure, and the skill of your surgeon. However, here are some general outcomes you may experience:

- Reduction of excess skin: An arm lift can effectively remove loose, sagging skin in the upper arm area. This can help eliminate the appearance of "bat wings" and result in smoother, firmer arms.

- Contour improvement: By removing excess fat and tightening the underlying tissues, an arm lift can enhance the overall contour and shape of the upper arms. It can create a more toned and defined appearance.

- Enhanced arm symmetry: If there is a noticeable asymmetry between the arms, an arm lift can help improve symmetry by addressing excess skin and fat on both sides.

- Increased confidence: The improved appearance of your arms can enhance your self-confidence and make you feel more comfortable wearing sleeveless or fitted clothing.

How can I finance an arm lift?

The most common ways to finance an arm lift are:

- Savings: an arm lift can be costly, especially if you’re also having other areas of your body lifted, but savings and investments should always be your first thought, even if they can only cover a portion of the surgery.

- Personal Loans: personal loans are the most popular choice for funding arm lifts and allow you to spread the cost over a long period, typically 2-5 years. How much you’ll be able to borrow depends on your creditworthiness, as does the interest rate you can get. Personal loans are a good choice if you are going to be covering a range of different expenses related to your treatment, as the lump sum is deposited directly in your bank account, rather than being paid directly to the surgeon.

- 0% APR Credit Cards: Credit cards aren’t always the best option for an arm lift, but if you have some savings to put toward your treatment or can get a relatively high credit limit, a card with a long 0% APR period or even just a low-interest rate (6% or less) can be worthwhile.

- HELOC: A Home Equity Line of Credit is a good option for more expensive procedures, such as an arm lift or full-body lift. This is where you get a line of credit (much like you get on a credit card) which you can borrow from as and when you please, only paying interest on the money you borrow. This form of borrowing is secured against your home, so you can generally get a much higher credit limit than you can elsewhere, and with a lower interest rate. The downside of HELOCs is that, because they are secured against your home, defaulting can put your home at risk.

- 401(k) Loan: Some 401(k) plans allow you to take out a loan from your future retirement savings. This is a good option if you have access to it because it doesn’t involve a credit check or interest. You usually have strict repayment rules for these loans, so make sure you do your research and find out what it means for your retirement plans.

- In-House Financing: Most cosmetic surgeons offer in-house financing, usually in the form of a personal loan through a partner lender. These are usually set up as a payment plan and the money is paid directly to the surgeon. These can have favorable terms but you need to do your research to ensure you can’t get a better deal through an external lender.

Compare Offers

Ready to find the best loan for cosmetics & plastic surgery procedures? Get started!

Need help finding the right loan?

No worries, we've got you covered! Compare personalized loan options in just minutes.

How Pasha Funding Works

Pros & Cons of Arm Lift Financing

PROS

- Finally get the body you want

- Get treatment now, rather than saving up

- Keep your savings intact

- Spread the cost

CONS

- Can be costly, and so getting a loan can mean you have to put other major life decisions on hold until you pay off the loan

- Financing options are expensive if you have fair or bad credit

What credit score do you need to obtain arm lift financing?

The specific credit score required to obtain arm lift financing can vary depending on the lender or financing program you choose. While there is no fixed credit score threshold solely for arm lift financing, having a good credit score generally increases your chances of approval and may lead to more favorable financing terms.

A good credit score is typically considered to be around 670 or higher. However, lenders may have different criteria and evaluate other factors in addition to your credit score when determining eligibility for financing. These factors can include your income, debt-to-income ratio, employment history, and overall creditworthiness.

Can I get arm lift financing with bad credit?

It’s unlikely, but it may be possible. You need to be realistic about what you can afford and understand that the worse your credit, the higher your interest rate will be. Use our calculator to find out if financing may be a realistic option for you or not.

How to Qualify for Arm Lift Financing

To qualify for arm lift financing, start by checking your credit score and aim for a good credit rating. Research different financing options offered by lenders, medical financing companies, or healthcare providers. Gather necessary documents such as identification, proof of income, and medical records related to the arm lift procedure. Fill out the financing application accurately and submit it along with the required documentation. Await approval and carefully review the loan offer, including interest rates, repayment terms, fees, and conditions. Consult with your plastic surgeon or their financial services department for guidance on financing options specific to arm lift procedures.

Cosmetic Financing Options

Breast

Body Lift

Male

Fat Reduction

Face & Neck

Personal Loans for Every Occasion

Find Your Best Rate

Compare Best Personal Loans

Personal Loan Payoff Calculator

Personal Loan Lender Reviews

Personal Loans By Credit

Personal Loans for Fair Credit

Personal Loans for Good Credit

Personal Loans for Excellent Credit

Personal Loan Types

Auto Repair Loans

Credit Card Consolidation Loans

Fast Personal Loans

Home Improvement Loans

Horse Barn Financing

Wedding Loans

Family Planning Loans

Funeral Financing

Land Purchase Financing

Manufactured Home Financing

Medical Loans

Cosmetic & Plastic Surgery Financing

Owner Builder Construction Loans

Personal Loans for House Down Payment

Personal Loans for Self Employed

Personal Loans for Furniture Expenses

Student Loans

Debt Consolidation Loans

Vacation & Travel Loans

Emergency Personal Loans

Personal Loans with Co-signers

Home Improvement Financing

Appliance Financing

Bathroom Remodel Financing

Basement Remodel Financing

Boat Dock Loans

Deck Financing

Driveway Paving Financing

Fence Financing

Flooring Financing

Furnace Financing

Garage Financing

Home Addition Financing

Hot Tub Financing

HVAC Financing

Home Insulation Financing

Interior & Exterior Painting Financing

Kitchen Remodel Financing

Kitchen Cabinet Financing

Pole Barn Financing

Roof Financing

Solar Panel Financing

Swimming Pool Financing

Sunroom Addition Loans

Window Replacement Financing

Loan rate & terms disclosure: Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.